Filter events by venue(0)

ACT | Le Monnot

Adham Al-dimashki's home gallery

AUB - Green Oval

AUB Ebooks

AUST Ebooks

Balamand Ebooks

Bkerzay

CAIRN PRO

Citysightseeing Lebanon

Clic Clac - Beirut Souks

District 7 Beirut

Emile Bustani Auditorium - Hotel Al Bustan

ESA Business School

Espace Matisse

Institut Français du Liban

International College Beirut

LAU Ebooks

Le Royal Hotel | Leisure Hills Complex

Librairie Antoine

Masrah Al Madina

Masrah Baladyet Al Jdeideh

Metro Al Madina

National Geographic Ebook

NDU Ebooks

Odeon Theater

Paragliding Jounieh

Pirouette Studio

Purple Pineapple Pot

Resurrection Church Beirut - RCB

Silk Factory

Station Beirut

Studio Laban

Théatre Beryte

Théâtre Le Monnot

Théâtre Tournesol

Vamos Todos

Wonders 2020 Ebooks

theater

Shu mnelbos? Directed by Yehia Jaber with Anjo Rihane

بعد النجاح الكبير للممثلة المتألقة "أنجو ريحان" في مسرحية " مجدرة حمرا "لأكثر من خمسة سنوات ومازالت مستمرة ،يتابع يحيى جابر المؤلف والمخرج تعاونه مع المبدعة أنجو ريحان في مسرحية جديدة و جريئة .

" شو منلبس؟"

مين بيلبّسنا فكرة او تياب ؟مين بيقرر" شو منلبس" ؟ شو يعني ماشي عالموضة أو دقة قديمة بالحب او بالسياسة او الثورة أو الزواج او اللي مش عاجبه عرينا أو لبسنا ؟.." شو منلبس " مين لبّسنا التهمة؟ مين لقطنا متلبّسين بحب الحياة او الموت .

"شو منلبس " مسرحية كوميدية حنونة ولابسة كتير الوان .

- Théâtre Le Monnot

- Mar 01 - 08:30 PM

theater

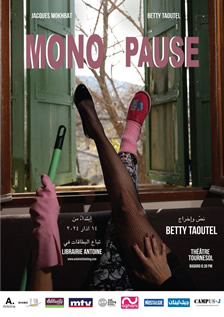

Mono Pause Directed by Betty Taoutel

هي قصة امرأة تقرّر أن تختفي عمداً . تدور أحداث هذه المسرحية في بيت جبلي

- Théâtre Tournesol

- Mar 14 - 08:30 PM

music

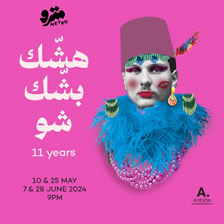

Hishik Bishik show

مترو المدينة يقدّم "هشك بشك شو"

- Metro Al Madina

- Apr 27 - 09:00 PM

theater

Al Souq Al Oumoumi

مترو المدينة يقدّم: السوق العمومي

"شارع بسيط عادي، بقلبو بنايات وبيوت ... بيوت للدعارة".

ليقنعو سكان بيروت قالولن انو هيدا الشارع مخصص ليحمي ولادكم من الفحشاء.

الشارع كان اسمو 'شارع المتنبي"

بين الواقع والمتخيَّل شارع البغاء في وسط بيروت ، من نافذة أشهر بترونات "سوق الأوادم" في زمن ما قبل الحرب.

"السوق العمومي" هو العرض الغنائي المسرحي الجديد لمترو المدينة.

- Metro Al Madina

- Apr 04 - 09:00 PM

theater

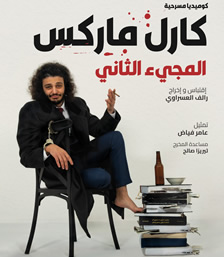

Karl Marx : The second Coming... Directed by Ralph Al Israwi

كارل ماركس المجيء التاني ...

كوميديا مسرحية مش مظاهرة .

ملخص : يعود كارل ماركس من الموت لساعةٍ واحدة فقط لزيارة بيروت و مناقشة الأحوال الإقتصادية ، الدينية ، الإجتماعية و السياسية بإطار كوميدي ساخر ، حيث يقوم بنقد ما يحدث في لبنان و العالم عن طريق نقده لنفسه أولاً .

لا يفوّت كارل ماركس هذه الفرصة ، و يتحدث عن حياته السابقة ، عائلته ، مشاكله الشخصية ، زوجته ،أولاده و أصدقائه و أفكاره. حيث يتعرف الحاضرون على جانب لا يعرفونه عن ماركس .

ملاحظة : لست بحاجة لمعرفة أي معلومة عن كارل ماركس مسبقاً ، للإستمتاع و فهم هذا العمل المسرحي .

- Studio Laban

- Apr 17 - 08:30 PM

family

Mini Studio Théâtre de marionettes interactif

Get ready for an enchanting adventure at our Interactive Puppet Show! Join us on Thursday, May 2 at 5 PM for an engaging experience perfect for ages 2 to 6.

Tickets are $25 for one child and one adult.

Don't miss out on the fun at District 7!

Reserve your tickets now at Antoine or call 81 233 144.

See you there!

- District 7 Beirut

- May 02 - 05:00 PM

theater

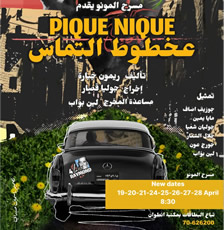

Pique-Nique mise en scène Julia Kassar

Pique-Nique

٤خطوط التماس

مسرحية لريمون جبارة

إخراج جوليا قصار

April – 20h30

تمثيل

جلال الشعار

جوليان شعيا

فؤاد مراد

مايا الخوري

مساعدة المخرج لين بواب

خرج الوالدين للتجول على خطوط التماس في وسط بيروت لزيارة ابنهما الذي يقاتل، دون أن يهتما بخطر الاختطاف أو إطلاق النار أو القصف. هناك، يلتقيان بمقاتل من الجانب العدو ويصبح أسيرهما. يتحول تعاملهم معه من العداء إلى علاقة صداقة ومحبة، حيث يتشابه الاثنان ولا يريد أحد الحرب. هذه المسرحية، التي استلهمت من "أرابال"، والتي أعيدت صياغتها وإخراجها على يدي الكاتب المسرحي العظيم ريمون جبارة في عام 1999، تدين الحروب وسفاهتها وقتل الأبرياء وجميع أشكال العنف، بلغة قاسية وساخرة وشاعرية في نفس الوقت. الحالات، التي لا تخلو من الفكاهة، تثير في المشاهد دهشة ومشاعر متضاربة بين الضحك والبكاء، الحزن والفرح. إعادة تقديم مسرحية "نزهة على الخطوط الأمامية" في زمن الحرب، ليست إلا تحية لعبقرية كاتب مسرحي أعماله تنغمس في الواقع السخيف والمؤلم للإنسان، فلا خلاص للإنسان بحسب جبارة إلا بالحب والسلام. من بين أقواله الشهيرة: "الولد الذي يرسم طائرًا لا يمكنه قتله عندما يكبر، ولذلك من المستحيل عليه أن يقتل زميله البشري".

The parents went out for a walk to the front lines in Downtown Beirut to visit their fighting son, not caring about the dangers of kidnapping, sniping, or bombing. There, they meet a fighter from the enemy side and he becomes their prisoner. His hostility soon turns into a friendly and loving relationship, as the two fighters are alike and no one wants war. This play, inspired by Arabal, which was rewritten and directed by the great playwright Raymond Gebara in 1999, condemns wars, their absurdity, the killing of innocents, and all forms of violence, in a harsh, sarcastic and poetic language at the same time. The situations, which are not devoid of humor, arouse in the viewer amazement and conflicting feelings between laughter and crying, sadness and joy. Re-presenting the play “picnic on the front lines” in times of war, is nothing but a tribute to the genius of a playwright whose works delve into the absurd and painful reality of man, for there is no salvation for man according to Gebara, except with love and peace. Among his famous sayings: “The boy who draws a bird cannot kill it when he grows up, and therefore it is impossible for him to kill his fellow man.”

- Théâtre Le Monnot

- Apr 19 - 08:30 PM

theater

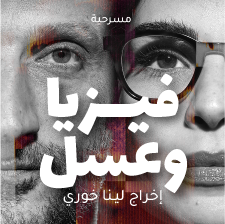

Physia w 3asal | فيزيا وعسل Directed by Lina Khoury

"فيزيا وعسل"، قصّة حب إستثنائية، ساحرة، تتخطى الواقع الذي نظن أننا نعيشه، وتتحدى حدود فهمنا للزمان والمكان. إنها قصّة إمرأة ورجل في علاقة واحدة، ولكن بإحتمالات متعددة.

"فيزيا وعسل"، مسرحية مضحكة مبكية مشاكسة، تحاكي الفكر وتأسر القلب؛ وتأخذ الجمهور في رحلة مغرية ومشيّقة. إنها مسرحية عن الحب، الأمل، الحياة، القدر، حرية الخيار، الفيزياء والعسل. عمل متين ومعاصر؛ الفكر التقليدي فيه هالك لا محالة.

- Masrah Al Madina

- Apr 25 - 08:30 PM

experiences

Wine Tour Bekaa With Vamos Todos

Lebanon holds a significant place in the history of wine production, dating back to ancient times when the Phoenicians played a pivotal role in its spread throughout the Mediterranean. Despite the region's numerous conflicts, Lebanon continues to produce approximately 600,000 cases of wine annually. In recent years, the wine sector has experienced remarkable growth, with the number of wineries increasing from 5 in 1998 to over 50 today.

- Vamos Todos

- Apr 27 - 08:30 AM

theater

Habibet Albi Enti by Lucien Bourjeily

A man wakes up on a bed to find himself bound and blindfolded by a masked woman who refuses to release him.

Is this the ultimate expression of sadistic passion? Or is it something else?

- ACT | Le Monnot

- Apr 27 - 07:00 PM

theater

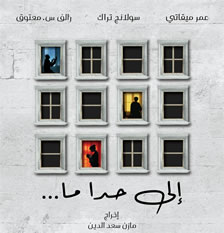

Ila Hada ma | إلى حدا ما Written & produced by Ralph S. Maatouk

Ila Hada Ma / إلى حدا ما

Written & produced by : Ralph S. Maatouk

Directed by : Mazen Saad El Din

Starring : Omar Mikati, Solange Trak and Ralph S. Maatouk

Synopsis:

لم يكن اللقاء بين سوسن وأليكس متوقعاً في هذا اليوم، فحديقة المستشفى من المفترض أن تكون خالية في هذا الوقت. لكنهما التقيا!

أليكس لديه الكثير ليقوله، وسوسن لن تبقى مستمعة...

Tickets - Free seating:

Regular ticket: 20$

Student ticket (student ID required): 10$ available on 03 596 086.

- Théatre Beryte

- May 22 - 08:30 PM

experiences

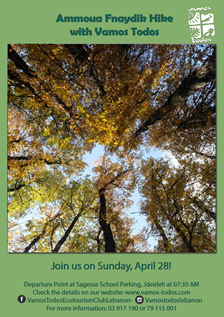

Ammouaa Fnaydik Hike with Vamos Todos

To grasp the essence of its name, envision yourself amidst a landscape resembling a funnel, enveloped by a diverse array of trees. That's precisely where our journey leads this time—to Ammoua.

Nestled in the heart of Akkar, Ammoua boasts numerous water sources capable of irrigating neighboring villages.

- Vamos Todos

- Apr 28 - 07:30 AM

others

Saj | Experimental Theatrical work with Adham Al Dimashki

Saj: is an experimental theatrical work that gathers the writer Adham Al-dimashki with his mother Shukriya Azzam in a session of SAJ and Mate in conciliatory narratives at their home in Achrafieh Geitawi.

صاج:

"يمكن مسرحيّة أو زيارة عزيزة علينا"

لـِ : أدهم الدمشقي

بالاشتراك مع والدته شكريّة عزّام

البطاقة 15$ (30$ بطاقة دعم) تُباع في جميع فروع أنطوان أو أنطوان Online.

المكان: محترف أدهم الدّمشقي، الأشرفية، الجعيتاوي، مقابل البنك اللّبناني الفرنسي، الكامب الأبيض، المبنى الثالث، الطابق الأرضي.

صورة البوستر: رالف موسى

- Adham Al-dimashki's home gallery

- Apr 29 - 08:30 PM

music

Cindy Latty , Tribute to Asmahan and Umm Kulthum

- Adham Al-dimashki's home gallery

- Apr 30 - 08:00 PM

experiences

Mazraat el Chouf to Bisri Hike with Vamos Todos

This Wednesday, we'll embark on a breathtaking trail, one of the most enchanting hikes that will imprint unforgettable images in your memory. Our journey will take us from Mazraat el Chouf to Bisri in the Chouf region.

During the hike, we'll encounter ancient olive trees and enjoy stunning views of Marj Bisri and the entire valley. Additionally, we'll have the privilege of traversing Roman stairs and passing through a remarkably beautiful Roman passage nestled within the cliff.

We'll follow a picturesque trail through captivating scenery until we reach Bisri.

Hiking along the riverbanks of Bisri involves crossing streams, navigating through tall forests, and marveling at breathtaking vistas that will leave a lasting impression.

- Vamos Todos

- May 01 - 08:30 AM

theater

Hal Hal Chi Tabi3e?

طلال الجردي وزياد عيتاني

في مسرحية

هل هالشي طبيعي؟ تقع أحداث هذه المسرحيّة في عيادة طبيب نفسي في بيروت، في السنوات الحاليّة. يستقبل الدكتور طلال "مريضاً" غير اعتيادي، لتصبح اللقاءات بينهما غير اعتياديّة، وجلسات علاج متبادل، في ظلّ ظروف خارجيّة على حافّة السورياليّة. تعكس الحوارات - التي تتحوّل أحياناً إلى اشتباك بين نمطين اجتماعيين وتفكيرين مختلفين- التعقيدات المتراكمة عند كلّ من الشخصيتين، من سنوات الطفولة الأولى في زمن الحرب الأهليّة، إلى عصر الانهيار الشامل في لبنان.

- Metro Al Madina

- May 01 - 09:00 PM

music

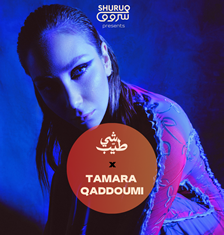

Shuruq Live presents TAMARA QADDOUMI x BONNE CHOSE

Shuruq Live presents

TAMARA QADDOUMI x BONNE CHOSE

Fresh off of her European tour, Tamara Qaddoumi’s homecoming show celebrates the release of her latest EP “Sorry Signal”, with a double bill featuring the electroacoustic groovers of Bonne Chose (fire)

Tamara’s music embraces her hybrid upbringing to explore themes of identity and belonging. Backed by guitars, synths and drums, her striking vocals oscillate between intimacy and vastness to create a sleek Cold Pop sound that’s both restless and reflective.

Sharing the stage on the night are the virtuose musicians of Bonne Chose, cookin up a sonic storm of psyche rock, groove jazz and synth wave.

Doors 9pm

Concert 9:30

Early $15 (Antoine)

Door $20

Cold Pop, Synthwave & Groove

@tamaraqaddoumi @bonnechose

#coldpop #synthwave #groove

#ShuruqLive @ShuruqMusic @putziproductions

@britishcouncillb @unesco.beirut

#BeirutLiveMusic #beirutevents

Event supported by British Council catapult.sonic & UNESCO Beryt.

The BERYT project is implemented by UN-Habitat through funding from the Lebanon Financing Facility that is administered by the World Bank . The CCI component is implemented by UNESCO Beirut.

- Station Beirut

- May 02 - 09:30 PM

experiences

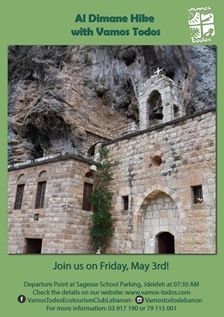

Al Dimane Hike with Vamos Todos

Qadisha Valley, situated within the Becharre and Zgharta Districts of the North Governorate of Lebanon, is a deeply sacred place. Carved by the Qadisha River, also known as Nahr Abu Ali as it flows towards Tripoli, this valley holds immense spiritual significance. Its name, "Qadisha," meaning "Holy" in Aramaic, aptly reflects its role as a sanctuary for Christian monastic communities over many centuries.

Rich in history, the valley is dotted with caves and rock shelters inhabited since ancient times, with cave chapels, hermitages, and monasteries carved into the rock. Recognized for its cultural importance, the entire valley, along with its cave churches, is inscribed on the UNESCO World Heritage List. With approximately 13 different trails, it offers diverse experiences for visitors.

- Vamos Todos

- May 03 - 07:30 AM

dance

Break into Deaf - El Hawas 5

Marking the occasion of the Arab Deaf Week, the well-known performer Pierre Geagea has choreographed a solo theatrical dance performance incorporating sign language.

It will be presented in Pirouette Studio in Ain Aar, with the help of the group “Al Hawas 5.

- Pirouette Studio

- May 03 - 08:00 PM

theater

Ghamed 3en Fate7 3en Written and Directed by Karim Chebli and Sara Abdo

In the heart of a cozy apartment in Beirut, Barhoum and Ayoud, a retired elderly couple, eagerly anticipate their son's return from abroad. As they engage in heartfelt reminiscences, playful bickering, and find solace in life's simplest joys, their story opens a window for audiences of all backgrounds to embark on a profound exploration of the human experience. Through poignant flashbacks to the tumultuous 1970s and 1980s, the audience is transported into the very heart of the couple's personal journey and the defining moments in Lebanon’s history. In this tale of love, sorrow, and unwavering strength, we glimpse our own reflections while journeying through a world where the quest for connection can lead us to uncharted alleys, where solitude patiently awaits around every bend.

"ابراهيم"، و متل عادته، بيستغل غياب المدام تيروّق راسه و يعمل سيجارة. و متل عادتها، "عايدة" بترجع عغفلة من تحويش الخبيزة و بتكمش برهوم بالجرم المشهود. و متل عادتهن بيعلقو. هي قلبها ع قلبه و هو ع حاله مش سألان.

من الآخر قصصهم قد ما عادية، صارت و بتصير و بتنعاد كل يوم ببيروت عندهن بالبيت، و عنا و عندك. هي قصة شخصين ما بقالهن غير بعض و شوية ذكريات. بس اليوم ع غير عادة القعدة بالحمام و منسترجع معهن ذكرياتهن بال سبعينات و الثمانينات، ذكريات جيل عاش الصمود و الخسارة بحب و ضحك.

Starring Fouad Yammine & Cynthia Karam

Written & Directed by Karim Chebli & Sara Abdo

- Théâtre Le Monnot

- May 03 - 08:30 PM

music

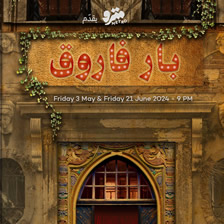

Bar Farouk

مترو المدينة يقدّم "بار فاروق"

عرض غنائي موسيقي يحاكي موسيقى المسارح والكاباريهات التي كانت منتشرة في بيروت فترة الثلاثينات وصولا الى سبعينات القرن الماضي قبل إندلاع الحرب الأهلية اللبنانية.

لوحات تتضمّن عشرات الأغنيات يؤديها 11 فناناً و فنانة موزعين بين موسيقيين، مغنين، ممثلين و راقصين يأخذوننا إلى حقبة الزمن الجميل التي كانت تعيشه بيروت في تلك الفترة

- Metro Al Madina

- May 03 - 09:00 PM

experiences

Serjbel Hike with Vamos Todos

Located in the heart of the Shouf district, Serjbel is a captivating typical Lebanese village. It is situated on the shore of Naher El Jahliyeh, a breathtaking river that runs through the region all year round. This stream hosts numerous waterfalls, the most famous of which is probably Serjbel Waterfall, visited by hundreds each year for its freezing cold water and heavenly atmosphere.

The locals have built and maintained stunning trails across the magnificent landscape and diverse flora of the area. Starting from Serjbel, we will make our way to the river, before taking a path crossing into the lovely villages of Chamaarine, Fkhaite, and Debiyeh.

- Vamos Todos

- May 04 - 08:30 AM

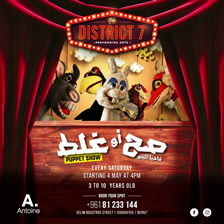

family

Sah aw Ghalat - Puppet Show

فاديا التنير تقدم بالتعاون مع ديستريكت ٧ بيروت عرض دمى تحت عنوان "صح أو غلط":

ميسا تشعر بالملل وحدها في حديقة منزلها، تتلقى بمناسبة عيد ميلادها مجموعة من الحيوانات.

تدور الأحداث حول أهمية النظافة والمحافظة على البيئة والترشيد حوال استعمال المياه بقالب مرح.

الهدف: التوعية من خلال التسلية بواسطة الدمى.

إضافة إلى نقاش خلال العرض مع الجمهور حول المواضيع المطروحة.

المدة: ٣٥ إلى ٤٠ دقيقة.

التاريخ: كل سبت ابتداءا من ٤ ايار الساعة ٤ بعد الظهر

العنوان: مسرح ديستريكت ٧ ،شارع سليم سلام ،الاشرفية

تباع البطاقات في كافة فروع مكتبة انطوان او الحجز على الرقم ٨١٢٣٣١٤٤

- District 7 Beirut

- May 04 - 04:00 PM

family

WilmA & MARYAM - Le théâtre de Gisèle

فيلما ومريم

ملخص المسرحية : تدور القصة في منزل فتاة صغيرة إسمها " فيلما"

تشكو الى والدها عن عدم أرتياحها الى المربية الجديدة في غياب أمها...

إلاّ أن الأب لم ينتبه الى ما تشير إليه طفلته، معتقدا" أن ما تقوله نابعا" عن دلع ولم يحاول معرفة السبب.

لذا يتركها بين أيدي المربية التي كانت مهتمّة بسرقة المنزل، و عاملت فيلما بقسوة وإحتيال

لكنّ الظروف الصعبة لا بد أن تنتهي...

تتدخّل "بابيت مريم" لمساعدتها على كشف حقيقة المربية وما كانت تخطط له.

العبرة :

· أهمية الإصغاء الى ما يحاول الطفل قوله لنا.

· البحث عما يقلقه.

· التأكد من كفاءة الشخص الملازم للطفل.

· أن لا نخذل طفلنا بعدم وثوقنا به.

الطفل أمانه لبناء السلام

جيزال هاشم زرد

WilmA & MARYAM

Résumé de la pièce :

L'histoire se déroule dans la maison d'une petite fille nommée WilmA.

Elle se plaint à son père de sa mauvaise relation avec la nouvelle nounou venue en l'absence de sa mère...

Cependant, le père ne prête pas attention ce à quoi sa fille faisait référence, estimant que ce qu'elle disait provenait d'une enfant gâtée et n'a donc pas cherché à en découvrir la raison.

Il la laisse entre les mains de la nounou : celle-ci s’avère vouloir cambrioler la maison et traite WilmA de manière dure et fourbe !

Mais cette situation doit changer !!!

C’est là que «Puppet Maryam» intervient pour l'aider à découvrir la vérité sur la nounou et ce qu'elle préparait.

Ce qu’il faut retenir à travers la pièce :

· L'importance d'écouter ce que l'enfant essaie de nous dire.

· Trouver ce qui l'inquiète.

· S’assurer de la compétence de la personne accompagnant l’enfant.

· Toujours accorder notre confiance à l’enfant.

L’enfant est un trésor pour bâtir l’humanité

Gisèle Hachem Zard

Jouée Par : Nathalie Gédeon A.A

Semaan Otayek

Patil Avedissian

Pauline Matta

Marie-josé Ibrahim

Marie Haykal

Karim Chehab

Marina Massabni

Texte : Gisèle Hachem Zard

Mise en scène : Mary-Lynn Zard Massabni

Assitant Réalisateur : Semaan Otayek

Scénoghraphe : Omar Zard

Chorégraphe : Pauline Matta

Styliste : Marlène Chedid

Régisseur : Marie Haykal

Directeur du Théâtre : Elie Dabbouss

Conception d’éclairage : Philippe Saba

Technicien sécurité : Elie Saad

Compositeurs : Toni Kamel

Omar Zard

Peter Nehme

Ramia Khoury & Alain Slim

Bassam Daccache

Production : OM2 Sal

Lieu : Théâtre Odéon/ Antélias

Prix de groupe, anniversaires, garderies, écoles, associations, Comités d’entreprises, sont à la demande. 81-411780 04/411780 [email protected]

Équipe OM2 Le Théâtre de Gisèle

- Odeon Theater

- May 04 - 04:00 PM

theater

Moujaddara Hamra Written and directed by Yehia Jaber

After the great success in the years 2018 2019 and 2020, “Moujaddara hamra” the play continue at Le Monnot

“Moujaddara hamra” is a play written and directed by Yahya Jaber and the actress Anjo Rihane has won the award of best actress for her performance in this play.

For Reservations :

• Whatsapp +96170912711

• Tickets available at the door

- Théâtre Le Monnot

- May 04 - 05:00 PM

Subscribe to

our Newsletters Weekly updates

Receive weekly event straight to your inbox. Stay tuned about the latest events nearby!

Follow us on Twitter Follow @Antoine_online